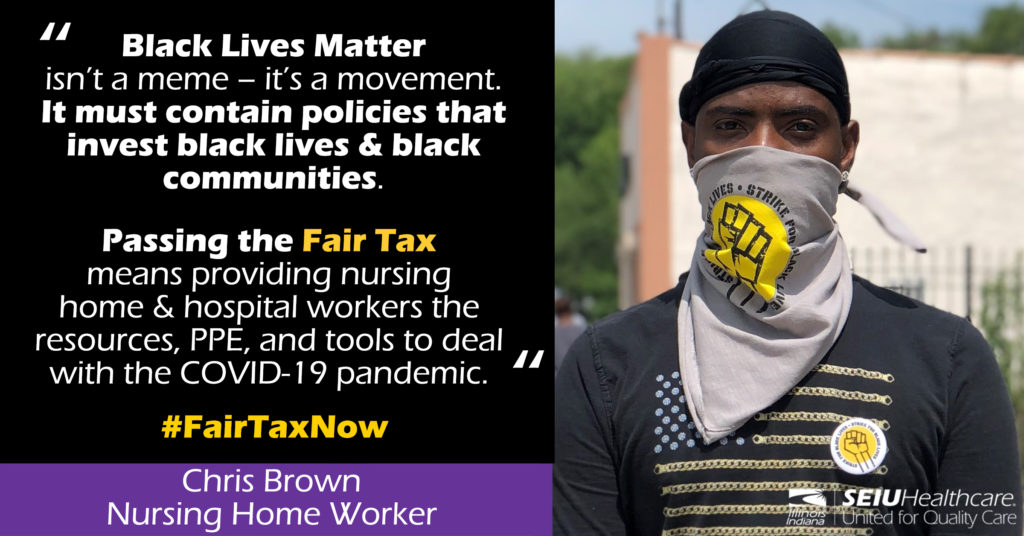

Leader Spotlight: Chris Brown, Nursing Home CNA, Gives Impassioned Speech for a Fair Tax at #StrikeForBlackLives Event: “The strike for black lives is not a meme – it’s a movement!”

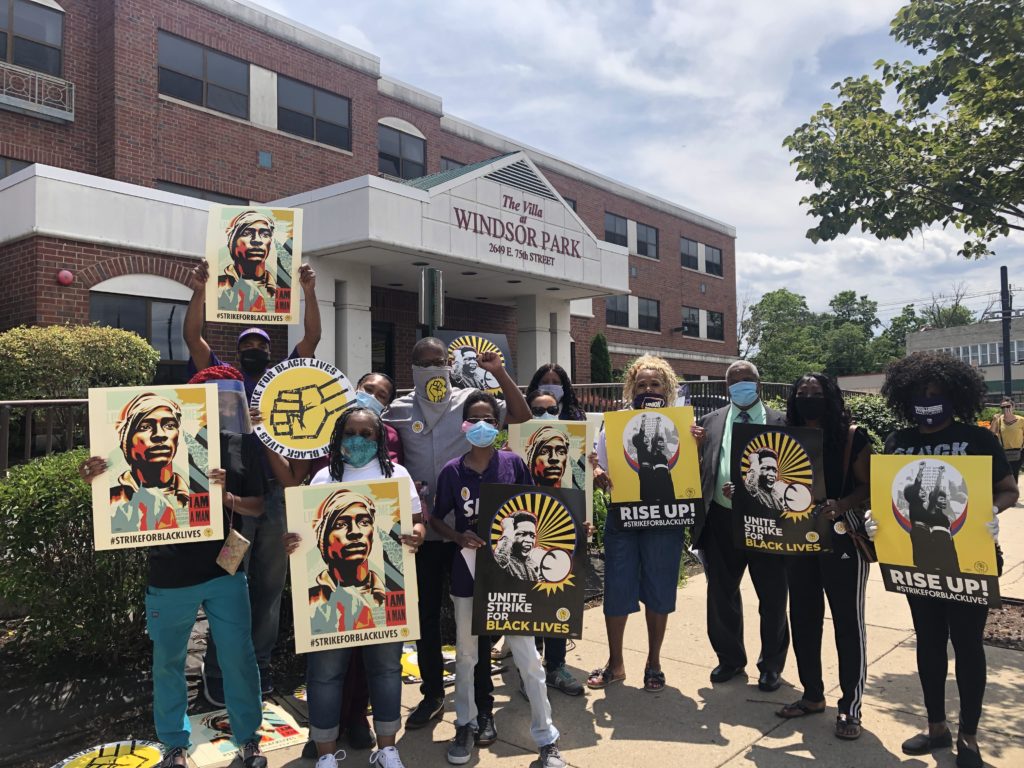

(July 20th, 2020, Chicago) — Our nursing home leader Chris Brown, a CNA from Elevate Care Chicago North, gave an impassioned speech at our #StrikeForBlackLives event outside the Villa at Windsor Park on the south side of Chicago to call on all Illinois voters to pass the Fair Tax on the November ballot to invest in “black lives, black families, and black families.” See the full text of his remarkable speech below.

I’m honored to speak at today’s historic National Day of Action, the #StrikeForBlackLives!

The strike for black lives is not a meme – it’s a movement.

And our movement must be meaningful – and substantial. It must involve real solutions.

It must contain policies that invest black lives, black families, and black communities.

Because Black workers need results — not rhetoric.

The movement for black lives must be a political and social movement that attacks the root causes of poverty, income equality, education and health disparities – and gives black communities the tools to rebuild our neighborhoods.

That’s why one of the most profound solutions for all working people – including the black community – is to commit to passing the Fair Tax on this year’s November ballot.

The Fair Tax simply says that those who earn more money, such as millionaires, should pay higher income taxes; and those who are earning less money should pay a lower income tax rate. It is the very definition of fairness.

And yet, this simple question on the November 3rd ballot, to get rid of our current and broken “flat tax” system — which allows a CEO who earns $1.5 million a year to pay the same tax rate as a nursing home worker who makes $15,000 a year — is absolutely ridiculous and immoral.

Because this simple change will mean that Illinois will raise an estimated $3.5 billion in new revenue that we need to expand healthcare for low-income families.

It means we can invest and scale our state’s child care program to serve working parents and single Moms as our early learning systems are on the brink of collapse.

It means we could provide nursing home and hospital workers the resources, personal protective equipment (PPE) and the tools to deal with the COVID-19 pandemic since President Trump clearly doesn’t care how bad the pandemic is and each state is fighting the virus alone without any leadership.

If you’re rich, or the head of a corporation, you simply can’t say you support “black lives matter” — then turn around and say you oppose the fair tax?

Don’t tell everybody you want to heal the racial wounds and racial divisions but then turnaround and say you don’t support investing more money into the lives of black workers and black communities.

If we want to create a more fair, equitable and just society that bridges the racial and economic gaps in Illinois, then yes, demanding the Fair Tax is absolutely essential.

The struggle to dismantle systemic racism is long and hard.

But right now, we have a moment and a solution right in front of us to make great strides to create more opportunity and hope for everyone – and passing the Fair Tax is the top of that agenda.

We simply cannot and must not let this opportunity to transform our state’s broken tax system that benefits the very rich go to waste. Thank you.